LAMINAR FOR FINTECH

Financial data security and compliance: Fueling innovation and trust

Modern fintech firms are architected as agile, born in the cloud, SaaS solutions that leverage data for innovation. For fintech companies, secure data and trust IS their business. As their business is built on trust, they require strict data security measures to comply with financial services regulations. Enable data innovation securely with Laminar.

- 74% PII

- 38% CREDENTIALS

- 21% BANK RECORDS

Percent of financial industry breaches in which sensitive PII data, credentials, or banking records were compromised

Verizon 2023 Data Breach Investigations Report (DBIR)

$5.90M

Average cost of a data breach in financial industry

IBM Cost of a Data Breach Report 2023

8 in 10

Adult U.S. citizens fear that businesses can’t secure their financial information

American Institute of Certified Public Accountants (AICPA)

Use Laminar’s Agile Data Security Platform for key FinTech use cases

Customer data

privacy and security

Insider risk (access

and de-anonymization)

Third party data

sharing risk

Risk-based environment

segmentation

Data privacy

regulation compliance

Faster incident

response

Data security

regulation compliance

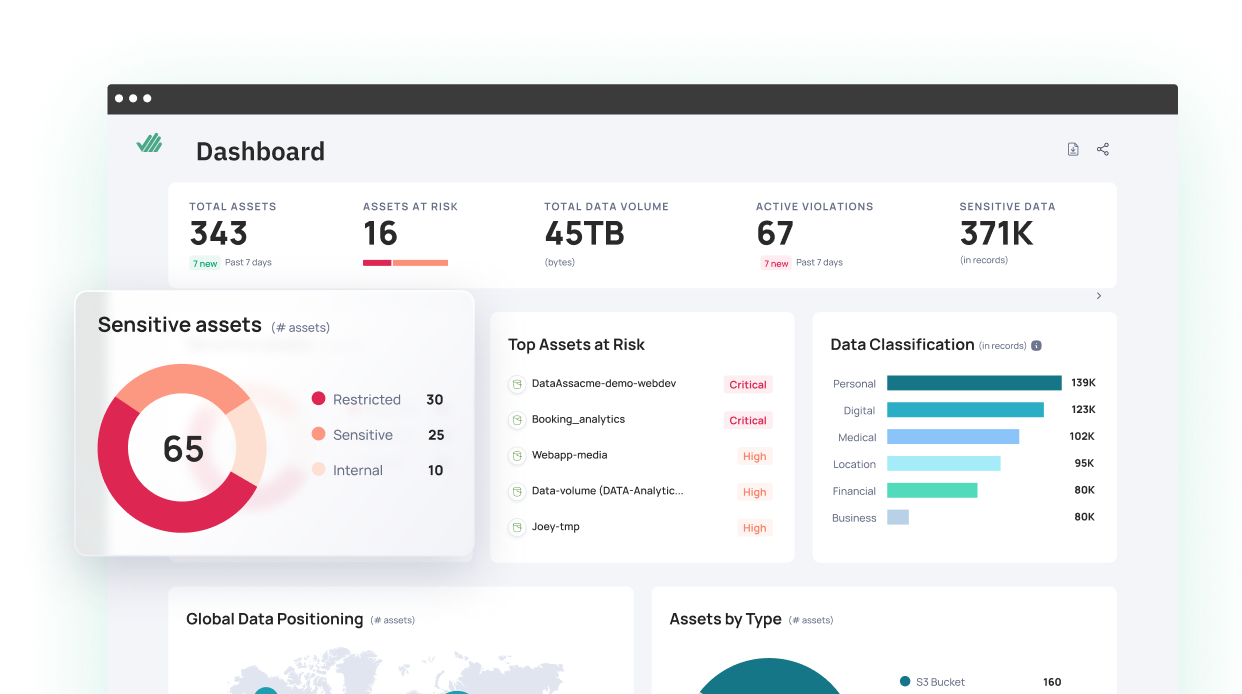

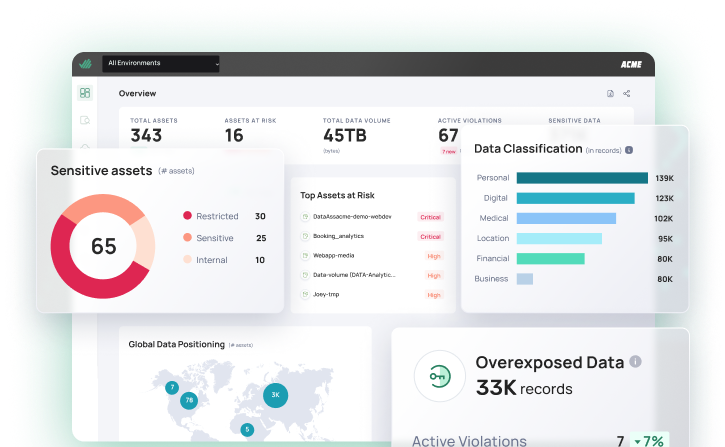

Gain complete visibility to cloud data

Autonomous and continuous data discovery and classification across multi-cloud environments. Sensitive data never leaves your cloud.

- 100% autonomous data discovery without burden of connectors or credentials

- Data never leaves your environment

- Rational, high-fidelity AI ensures classification accuracy

- Agentless, asynchronous, and smart scanning reduces overhead and doesn’t affect production

- Structured and unstructured data, including managed and self-hosted datastores, in public cloud, data warehouses, and SaaS

Secure your sensitive data

Enforce data security posture management with context-driven actionable alerts and guided remediation.

- Continuous monitoring of data security posture against out-of-the-box and custom data security policies

- Prioritized alerts based on risk integrated with your ticketing or ISTM platform

- Context-driven and guided remediation of violations

- Continuous validation of secure data storage including location, encryption, masking, retention and more

- Integration with other security solutions to quickly identify data at risk

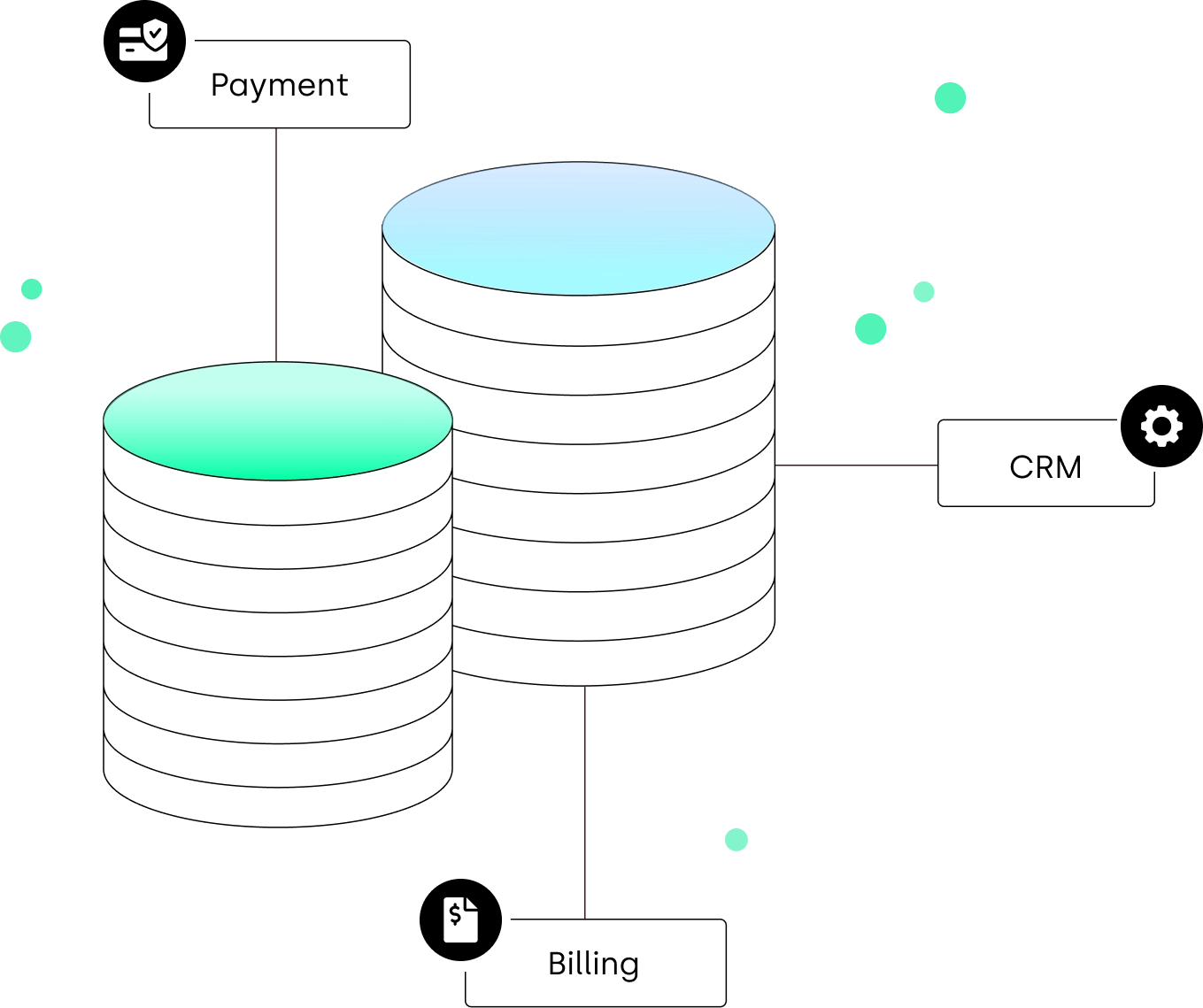

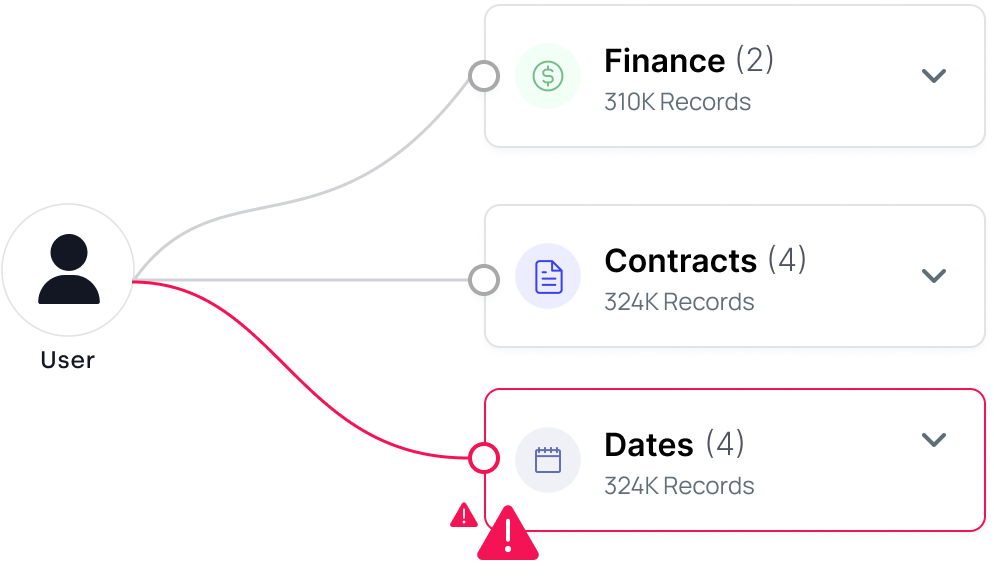

Limit access to reduce blast radius

Visualize and control user and machine access to sensitive data and ensure least privilege.

- Oversight and control over everyone who has access to specific data types

- Investigate over-permissive access through understanding all sensitive data each identity can access

- Integrated with your identity provider to understand identities not just roles

- Know your riskiest identities for increased monitoring and oversight

- Validate least privilege and monitor risky third-party access

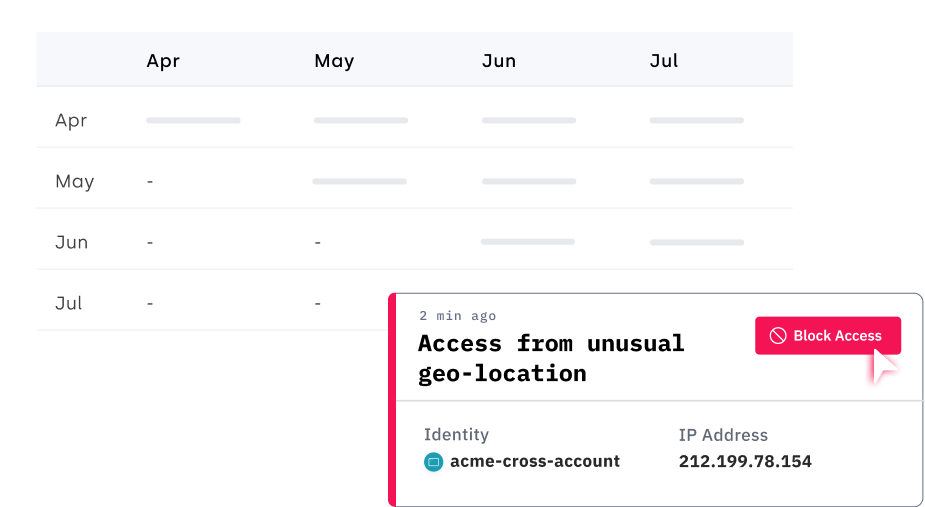

Detect and respond to data threats

Detect data breaches as they occur with a DDR solution to quickly contain active threats and minimize potential damage to your business.

- Identify and actively monitor access logs of your most sensitive data for risky and anomalous access

- Reduce MTTD and MTTR

- Instantly know what data was involved and assess potential impact of a breach

- Incident-specific playbooks for quick containment and remediation

- Integrated with your SIEM, SOAR or ITSM

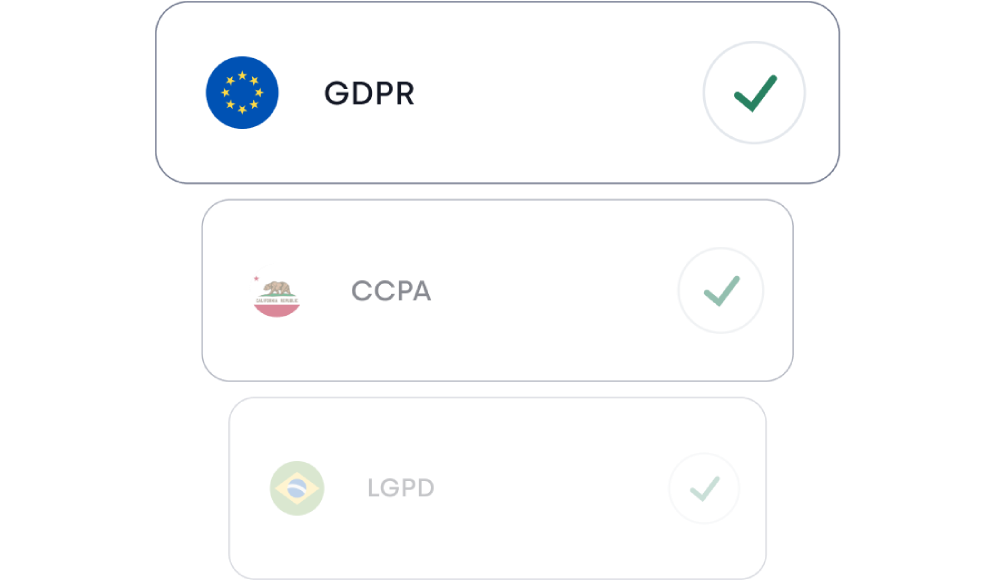

Fast-track compliance

Ensure compliance with policies that highlight exposures for PCI-DSS, SWIFT CSP, GLBA, FINRA, FISMA, NYDFS, GDPR, CCPA, Fair Lending, SEC S-P and more.

- Provide evidence of control for auditors

- Actionable alerts for compliance violations

- Out-of-the-box and customizable policies by regulation

- Enforce data environment segmentations

- Identify and remediate data sovereignty violations

Fintech data security case studies

See Laminar’s Data Security Platform in Action

Request a personalized demo to see how Laminar can help you.

REQUEST A DEMO